What’s the Actual Value of Your Home? Three Home Values That You Should be Aware of!

Video Overview

What you think the actual value of your home is may not be what it will be valued at in all situations. So what’s the actual value of your home? There isn’t just one value that you can refer to regarding your home’s worth. There are actually three home values that you should be aware of. There is the market value, the assessed value, and the replacement value that can not only affect your home’s worth differently but can hurt you if you are trying to sell your home at its assessment value price, for instance.

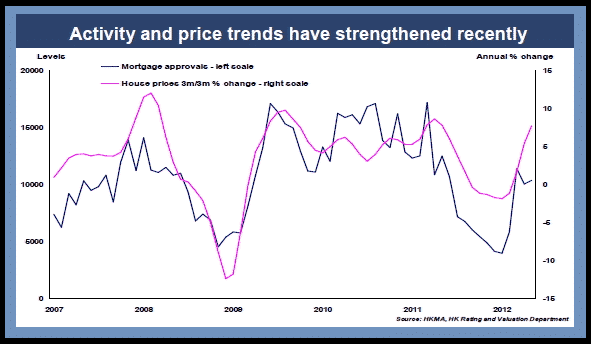

Market value is what your house is currently worth on the market to a potential buyer. If you are planning to sell your home in the near future, be prepared for the actual value of your home to either: not meet your expectations or to have an outcome that is way more than actual value of your home. Although things are improving, many markets in the US have not fully recovered since the burst of the housing bubble in 2008. Research recent properties that have sold in your area that are comparable to your property to determine if you have the actual value of your home correct. On the flip side however, if you live in a few prime locations like Silicon Valley or San Francisco you may make some money for selling your home. In a few areas in the US the housing markets are on fire because there are a lot of approved buyers but few homes for sale leaving many people to bid over one house, giving you homeowners more money than what the actual value of your home was. The reason that many home owners aren’t selling is because they are behind on their mortgage or don’t think that they have enough equity on their home to be in a position to sell. That should change soon as Money magazine, USA Today, and The Wall Street Journal all doing stories on this housing boom! Check out this article about the resurging housing market on CNN Money. People will reconsider selling and the first ones to do it are going to benefit the most. If you’re not in any prime locations like these, holding on to your house and wait a few years for the market to pick back up in order to receive the best ROI for your home.

The Assessed value of your home is based off of what your local tax assessor has valued your home at. This is important because you pay property taxes based off that assessed value. In some cases the assessed value is affected by the city that you live in. For instance, in some cases the assessed value may be much higher than the actual value of your home. If this happens to you, you have the option to appeal your assessment. Using your bank’s original appraisal value as evidence can help you prove that the assessment is wrong (especially if it is a few hundred thousand more than what you bought your home for). In many cases the county will lower it closer to the actual value of your home but keep in mind that some counties have limits on how often you can appeal.

Replacement value refers to the price that an insurance company will cover you for in the event that your home needed to be rebuilt from the ground up…a total loss. There is a misconception that to the value to rebuild should be equal to or less than the actual value of your home in a seller’s market. But in many cases, especially if you are in an area with diminished home prices, then the cost to rebuild your home could be much higher than actual value of your home. This is definitely a good time to review your homeowner’s insurance policy to make sure that you have adequate coverage for your home since building costs are at a five-year high.