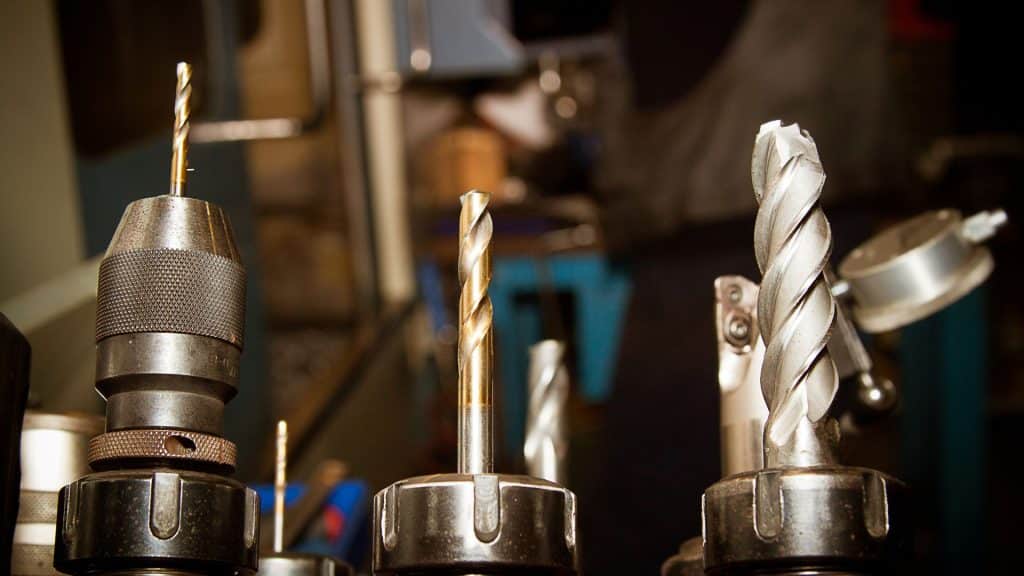

One factor that determines the performance and durability of a drill bit is its material composition. Learn about the most common types of metal alloys used in drill bits to discover what makes drill bits powerful tools.

1. Carbon Steel

Carbon steel is one of the most widely used alloys in drill bit manufacturing. Its enhanced hardness and strength make it suitable for drilling through various materials.

- Low-carbon steel contains up to 0.3 percent carbon and can drill softwood and some plastics.

- High-carbon steel contains up to 1.5 percent carbon and can cut hardwood and soft metals.

Carbon steel bits are relatively inexpensive and popular for general-purpose drilling applications. However, they aren’t suitable for use with harder materials like stainless steel or concrete, as they may dull quickly or break under excessive pressure.

2. Cobalt

Cobalt alloys are another common type of metal used in drill bits. These premium drill bits are particularly useful for drilling through hard materials, including stainless steel, cast iron, and titanium.

Cobalt enhances the bit’s heat resistance, hardness, and durability. Cobalt bits can withstand high temperatures generated during drilling, reducing the risk of overheating and extending their lifespan. These bits offer excellent cutting performance and are less prone to chipping or breaking.

M35 and M42 Cobalt Drill Bits

The two most common cobalt bits are the M35 and M42, which contain 5 percent and 8 percent cobalt, respectively. The M42 drill bit has many applications in industries that require cutting hard metals, such as the automotive and metalworking fields.

3. Tungsten Carbide

Tungsten carbide is one of the hardest drill bit materials on the market. Drill bits can either have tungsten carbide tips or tungsten carbide throughout their bodies.

The bit’s superior hardness and wear resistance makes it possible to withstand high forces and abrasion. So they maintain their cutting edges for a long time and drill efficiently. Professionals typically use them in heavy-duty applications for drilling through concrete, masonry, and other tough materials.